What is GST? A Comprehensive Guide on Goods and Services Tax

Goods and Services Tax (GST) is an indirect tax in India designed to streamline the tax system by unifying multiple previous taxes, including VAT, excise duty, and service tax. Understanding what is GST is essential for businesses and consumers as it simplifies taxation, promotes transparency, and supports economic growth.

Understanding What is GST

The Goods and Services Tax, or GST, is a value-added tax levied on most goods and services in India. It’s a destination-based tax collected at the point of consumption rather than production. One of GST’s significant advantages is the input tax credit system, which helps avoid the “tax on tax” issue.

Key Components of GST

- CGST (Central Goods and Services Tax): Collected by the central government on intra-state sales.

- SGST (State Goods and Services Tax): Collected by the state government on intra-state sales.

- IGST (Integrated Goods and Services Tax): Collected by the central government on inter-state sales.

- UTGST (Union Territory Goods and Services Tax): Applied in union territories.

What is GST Number (GSTIN)?

Each taxpayer registered under GST receives a unique GST Number, known as GSTIN (Goods and Services Tax Identification Number). This 15-digit alphanumeric code helps businesses with compliance and allows for tracking across the GST network.

Structure of the GST Number

- State Code (First 2 Digits): Identifies the state of registration.

- PAN (Next 10 Digits): Based on the taxpayer’s PAN number.

- Entity Code (13th Digit): Reflects the number of registrations the business holds within a state.

- Check Code (15th Digit): An alphanumeric verification code to ensure authenticity [2].

Why GST Was Implemented: Objectives and Benefits

India introduced GST in 2017 to simplify indirect taxation and boost economic efficiency. Previously, businesses had to navigate multiple taxes with varying compliance requirements. Now, GST offers a unified tax framework that is more transparent and accessible.

Benefits of GST

- Reduced Cascading Taxes: By allowing input tax credits, GST prevents the “tax on tax” phenomenon.

- Simplified Compliance: A single tax system reduces paperwork and streamlines tax filing.

- Boosts Economic Activity: A unified tax structure promotes trade and investments.

- Enhanced Transparency: Digital records and regular filings reduce tax evasion [1].

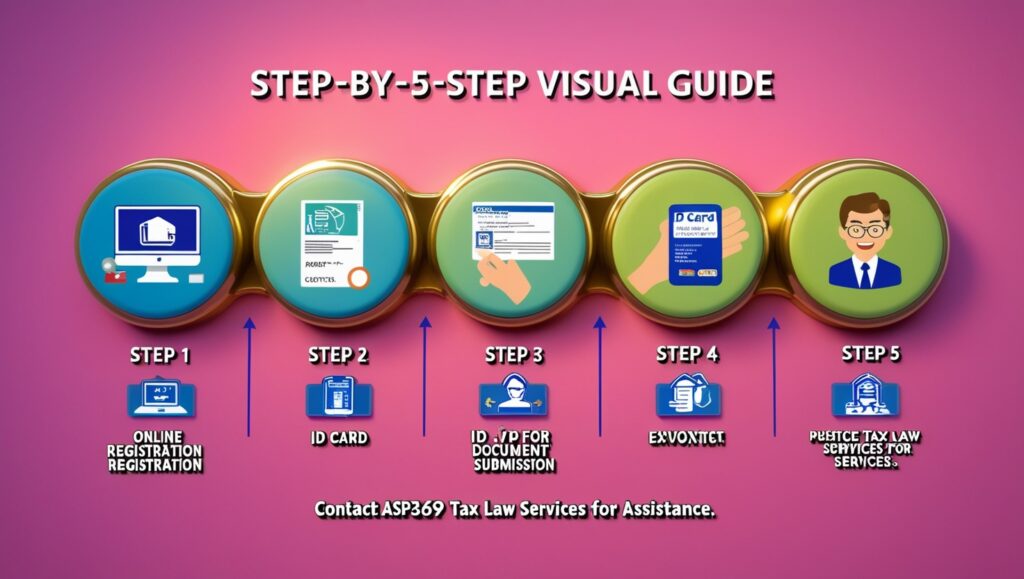

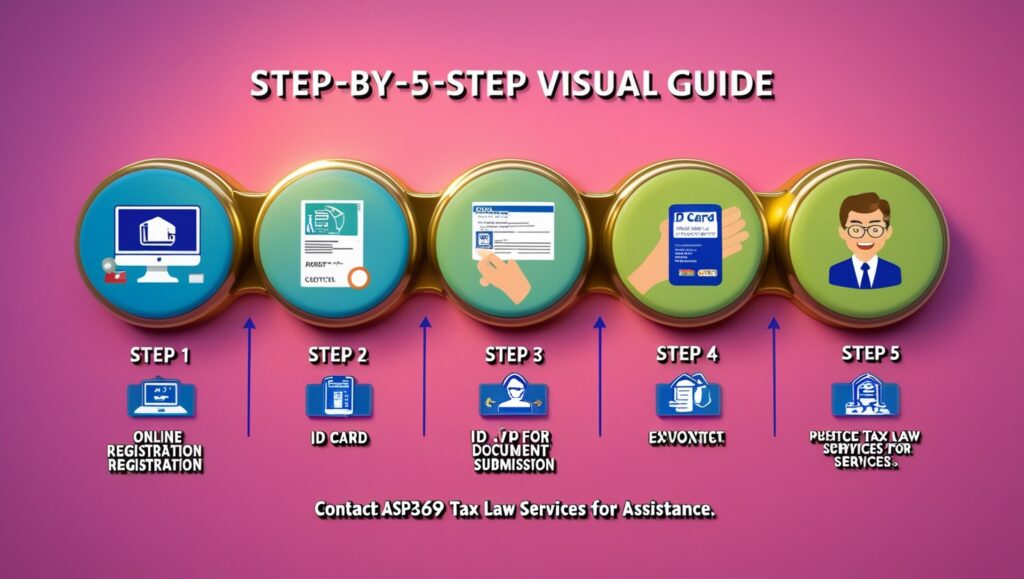

Step-by-Step Guide to Register for GST

For businesses with an annual turnover exceeding Rs. 20 lakhs (or Rs. 10 lakhs for certain states), GST registration is mandatory. Below is a simplified guide to help you get started. If you need assistance, you can consult ASP369 Tax Law Services at asp369taxlaw.com for expert support throughout the GST registration process.

Steps to Register for GST

- Visit the GST Portal: Start by visiting the official GST portal.

- Click on “New Registration”: Choose “New Registration” under the registration tab.

- Enter Details: Submit details like PAN, email, and mobile number.

- Complete Application: Fill in business details and upload required documents (e.g., PAN, business registration certificate).

- Verification: Once verified, your GSTIN will be issued electronically.

Need assistance? Contact ASP369 Tax Law Services for a smooth and hassle-free GST registration experience.

How to Verify a GST Number

GSTIN verification is essential for ensuring the authenticity of vendors and partners. GST numbers can be verified online through portals like ClearTax or the official GST portal, helping businesses reduce fraud risk and maintain compliance [2].

Conclusion

GST has reshaped India’s tax landscape, making it more transparent and business-friendly. Understanding what is GST and the significance of a GST number is vital for compliance and efficient business operations. With simplified processes and economic benefits, GST contributes to a more streamlined tax system that supports long-term economic growth.

For professional tax consultation and assistance with GST, reach out to ASP369 Tax Law Services.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.