ASP 369 TAX LAW CONSULTANCY – Call Now : 8218477767

Let’s be real—nobody starts an e-commerce business to spend hours decoding tax laws 😩. Between managing inventory, customer queries, and midnight marketing sprints, GST registration often lands at the bottom of your to-do list 📝. But here’s the kicker: A few overlooked details now could burn a hole in your wallet later 💸. I’ve seen it happen to fellow sellers, and trust me, the frustration isn’t worth it. Let’s unpack five slip-ups that could cost you big, and how to dodge them like a pro 🕺.

1. “I’m Probably Exempt, Right?” – Misjudging Your GST Liability 🤔

The Trap:

New sellers often assume their small-scale operations don’t need GST. Maybe you’re thinking, “I’m just selling handmade candles part-time—why bother?” 🕯️ But here’s the catch: If you’re selling through platforms like Amazon or Meesho, GST registration is mandatory 🚫 regardless of turnover. Even a single overlooked sale can trigger penalties 😱.

Your Fix:

Don’t play the guessing game 🎲. Check the latest thresholds (currently ₹40 lakh for goods 📦, ₹20 lakh for services 💼) and platform-specific rules. Still unsure? A 10-minute call with our “asp 369 tax law consultancy” 🧑💼 can save you months of headaches 🤯.

2. “I’ll Just Copy-Paste My PAN Details” – Submitting Sloppy Docs 📑❌

The Trap:

Rushing to upload documents? One seller I know accidentally submitted his expired lease agreement 🏠. The result? His application got rejected twice, delaying his launch by a month ⏳. Typos in your PAN, address mismatches, or blurry scans 📸 can derail your entire application.

Your Fix:

Treat your GST docs like a first date 💃—impression matters. Create a checklist:

- ✅ Valid PAN card

- ✅ Bank account proof (ensure IFSC is visible 🏦)

- ✅ Business address proof (even if it’s your home 🏡)

- ✅ Digital signature (Class 2 or 3 ✍️)

Double-check every field. Better yet, ask a detail-obsessed friend 🔍 to review it.

3. “Oops, Typo!” – Ignoring Data Accuracy ⌨️🚫

The Trap:

Ever typed your email as “.con” instead of “.com”? 😅 Now imagine that in your GSTIN application. One entrepreneur I met entered ₹5,00,000 as ₹50,00,000 in his turnover field 💸. The portal auto-rejected it, and he lost 15 days fixing it 📆.

Your Fix:

Slow down 🐢. Fill the form over two sittings—fresh eyes catch errors 👀. Use tools like Grammarly for numbers 🔢. Pro tip: Save drafts section-by-section instead of cramming it all in one go 🧩.

4. “I Don’t Need a Tax Consultant” – Skipping Professional Help 🙅♂️💼

The Trap:

A friend once bragged about saving ₹2k by filing GST himself 💪. Fast-forward 6 months—he got a ₹18k penalty notice for misfiling returns 📜. Turns out, he’d mixed up SGST and IGST 🔄.

Your Fix:

Think of a Tax Consultant as your GPS in the GST jungle 🌍🗺️. Platforms like ClearTax or Pocketful offer affordable packages 💡. Even a one-time consultation (around ₹1,500) can clarify essentials like HSN codes or return schedules or deligate your main work to expert accounting firms and invest your valuable time in growing your business instead of day-to-day repeated tasks like Sales,Purchases,Journal Entries,Accounting,Etc. 📅.

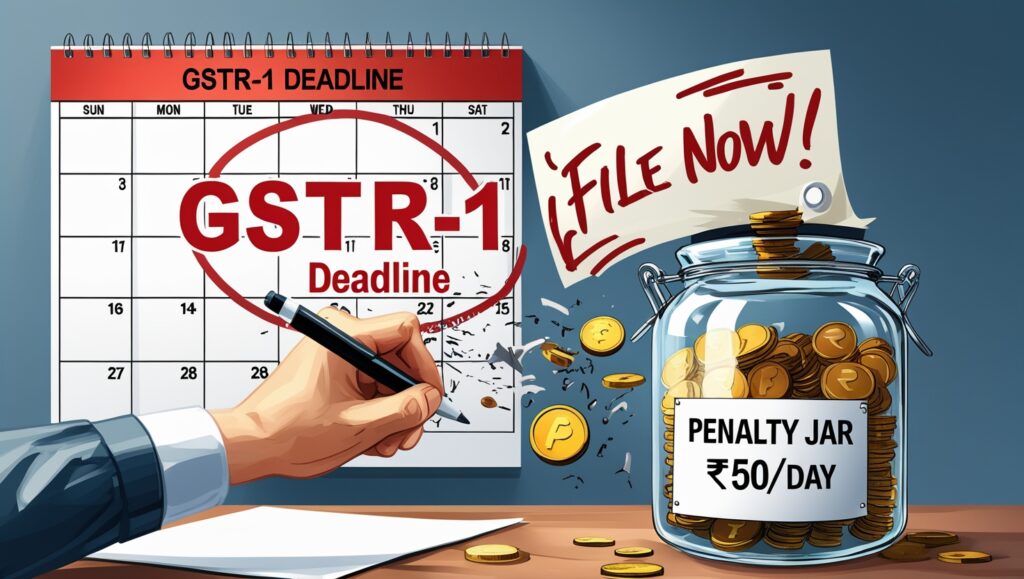

5. “Deadlines Are Flexible… Right?” – Procrastinating Compliance ⏰🚨

The Trap:

GST isn’t a “set it and forget it” task 🧾. Miss a deadline? Penalties start at ₹50/day (CGST + SGST) and cap at ₹10,000 💔. One seller forgot to file his GSTR-1 for 3 months and ended up paying ₹7,200 + interest 😤.

Your Fix:

Use free tools 🛠️:

- 📅 GST Portal’s Calendar: Bookmark it.

- 📱 Apps like Khatabook: Get auto-reminders for filings.

- ⏳ Monthly “Tax Hours”: Block 2 hours every 25th to reconcile invoices 📊.

The Bottom Line 🌟

Yes, GST feels like adulting on steroids 💪😓. But here’s the bright side: Nailing compliance early builds credibility 🏆. Buyers trust registered sellers, and platforms prioritize you for promotions 🚀.

Take it from someone who’s been there—spend a weekend organizing your GST basics 🧹. Future-you will high-five present-you when those penalty notices never arrive 🎉. Consultant now with “ASP 369 TAX LAW CONSULTANCY” for expert advice.

P.S. Stuck on HSN codes? DM me—on Linkedin(https://www.linkedin.com/in/ankit-parihar-853962236/)I’ll share the cheat sheet I used for my first GST filing! 📋😊

Got a GST horror story or hack? Drop it in the comments—let’s save each other some cash! 💬👇